These are useful in providing statistically important support and resistance levels. Standard Deviation, which is a measure of past volatility, provides a mathematical possibility of trading range based on the mean values over the course of 1-year. These moving averages are the calculated price which the underlying symbol needs to reach for the price to be considered "above the moving average." These figures are not available on a chart.

The moving average periods shown on the cheat sheet (9, 18, 40) were popular with floor traders back in the day. 2nd Support Level: (S2) = PP - (R1 - S1).3rd Resistance Level: (R3) = H + (2 * (PP - L)).2nd Resistance Level: (R2) = PP + (R1 - S1).1st Resistance Level: (R1) = (2 * PP) - L.Support and Resistance points are based on end-of-day prices and are intended for the current trading session if the market is open, or the next trading session if the market is closed. The pivot point and its support and resistance pairs are defined as follows, where H, L, C are the current day's high, low and close, respectively. Pivot points are used to identify intraday support, resistance and target levels.

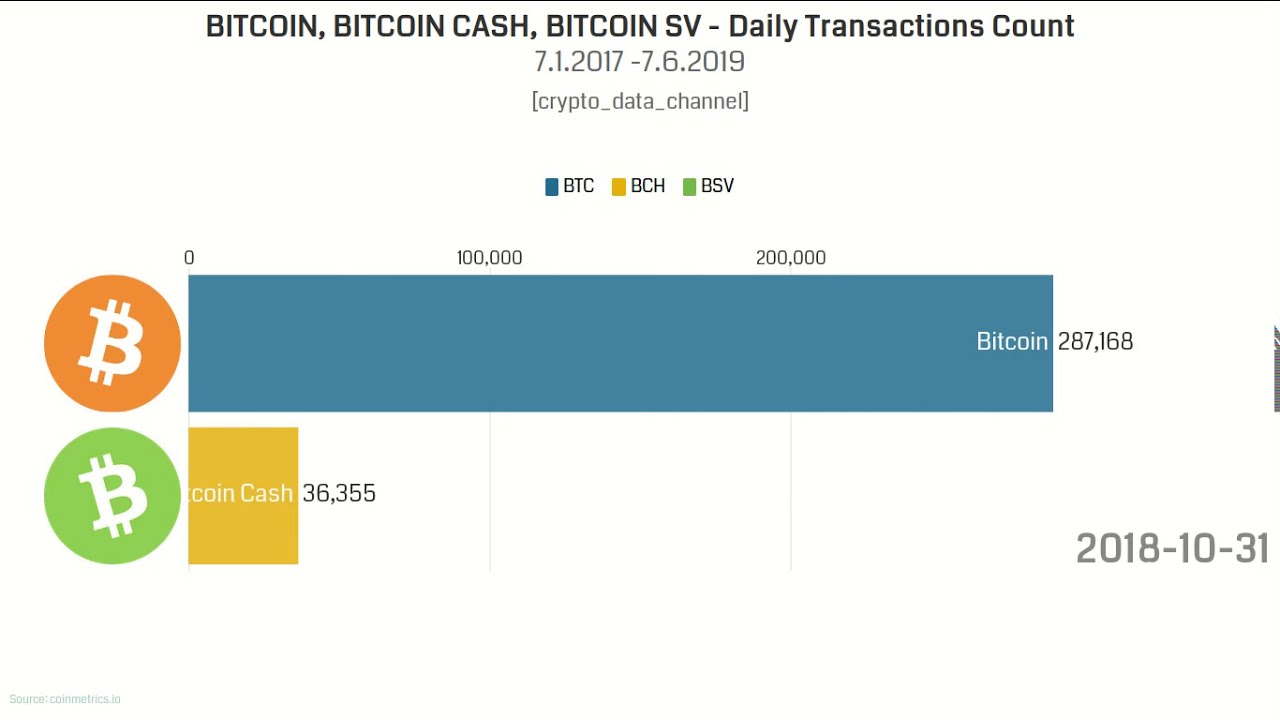

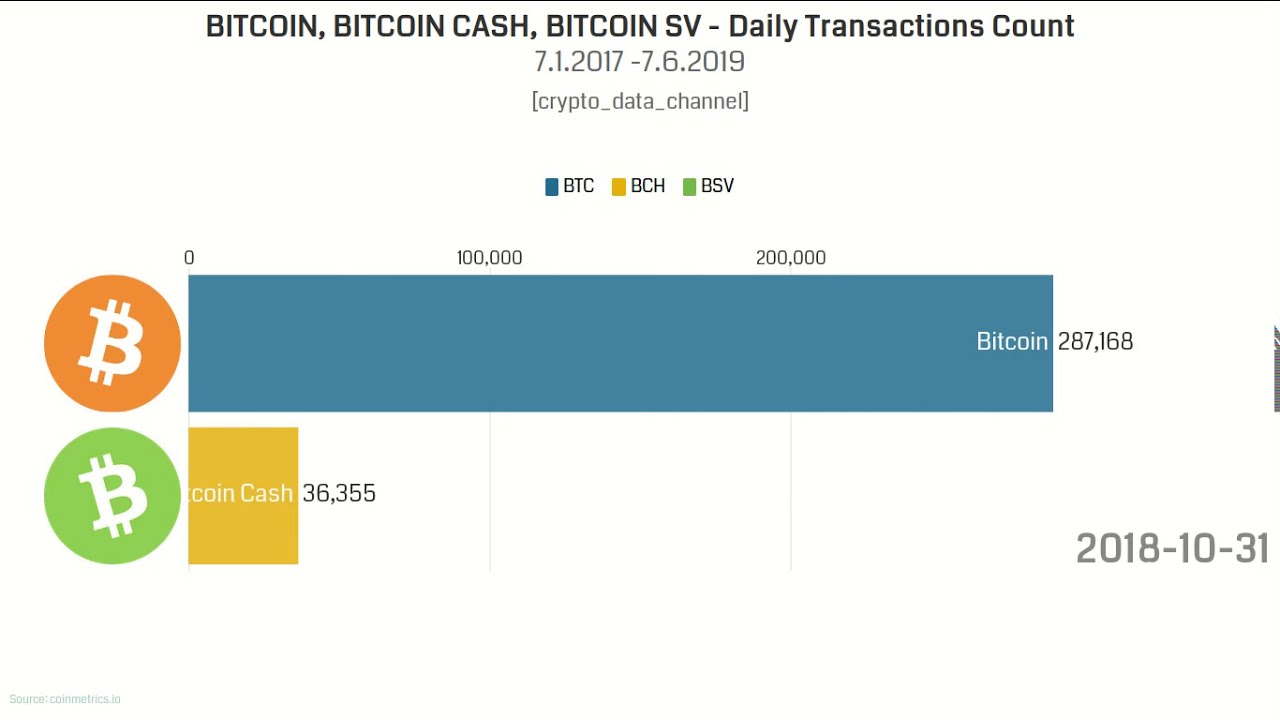

#Bitcoin bar graph update#

The Last Price will update only when the page is refreshed. The Last Price shown is the last trade price at the time the quote page was displayed, and will not update every 10 seconds (as the Last Price at the top of the Quote page does). We show four separate pivot points (2 Support Levels, and 2 Resistance Points).

Value1 = (3 times %D Stochastic - 2 times %K Stochastic). Stall = (Value1 * Value2) + 14-Day Lowest Lowīarchart defines the 14-Day %D Stochastic Stalls as follows:. Value2 = (14-Day Highest high minus the 14-Day Lowest low) / 100.0. Value1 = (3 times %K Stochastic - 2 times Raw Stochastic). A price projection of 0.00 is valid for a technical indicator if the calculation determines it will be impossible to trigger the signal.īarchart defines the 14-Day %K Stochastic Stalls as follows: The closer the trigger price to the current price, the more quickly it will come into play. Some of these projections will produce trigger prices so far removed from the price action that they can be ignored. Others, such as crossovers of a short-term and a long-term moving average, are interpreted as a reversal of the current signal. Some of these signals, such as Fibonacci Retracements, have a fixed bullish or bearish interpretation. Blue below the current price and red above will tend to keep trading in a narrow band, whereas blue above the current price, or red below can produce a breakout where each new price level is confirmed by a new signal. The complete Cheat Sheet can be used to give an indication of market timing. Red areas below the Last Price will tend to provide resistance to confirm the downward move. Blue areas above the Last Price will tend to provide support to confirm the upward move. Red areas above the Last Price will tend to provide resistance to limit the upward move. Blue areas below the Last Price will tend to provide support to limit the downward move. This legend can be found at the bottom of the Cheat Sheet page: These are shaded in blue if the common interpretation of the signal is bullish, and shaded in red if the common interpretation of the signal is bearish.Įach projection on the ladder can be examined to determine if the price change to each trigger level will tend to confirm or reverse the price move. The projected trigger prices of the signals are listed from highest price at the top of the page to lowest price at the bottom. The Cheat Sheet is based on end-of-day prices and intended for the current trading session if the market is open, or the next trading session if the market is closed. The Trader's Cheat Sheet is updated for the next market session upon receiving a settlement or end of day record for the current market session.

The Trader's Cheat Sheet is a list of 50 commonly used technical indicators with the price projection for the next trading day that will cause each of the signals to be triggered.

0 kommentar(er)

0 kommentar(er)